I’m getting this out on Friday evening because I don’t want to half of it written and then something happens either tonight or sometime Saturday when I’m doing yard work and my time spent writing it becomes wasted. Instead we’re going to split the weekend post in two, half tonight, the market recap/general thoughts, and the other half on Sunday in which I talk about stocks I’m targeting nearer term. Enjoy and please feel free to share.

This was a heat check week. One where the market gave us plenty of signs it wanted nothing to do with a new all time high. Yes, it took bombs in the middle east to break us lower on Friday but that was the headline that caused the sell off that was building.

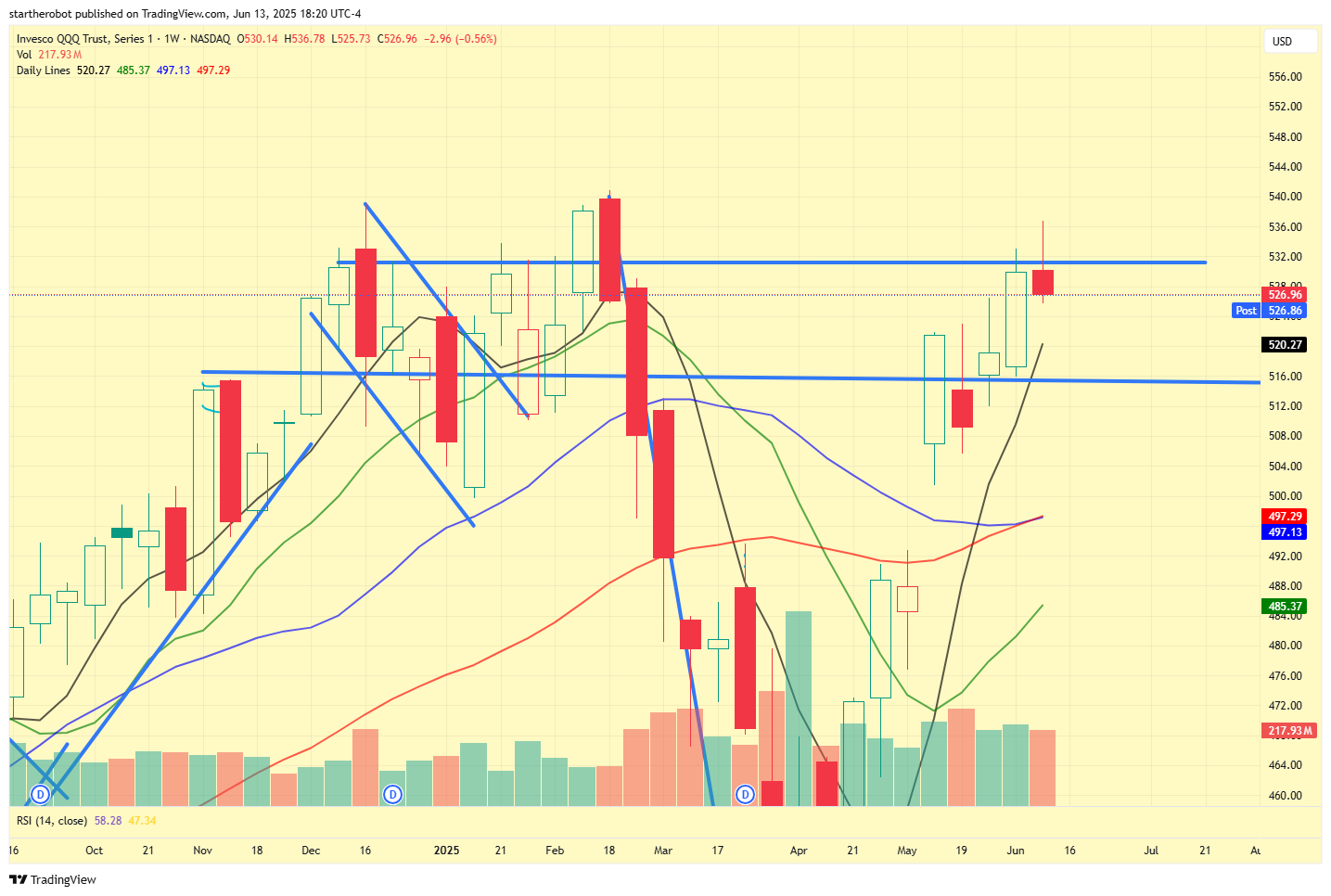

Looking at the daily of the QQQs and SPY, there was at least three, possibly four depending on how you want to count wednesday’s, exhaustion candles that can be easily eyeballed in the last 12 sessions.

On a slightly longer time frame we printed an exhaustion candle on the weekly. While it is possible we move higher a month from now, nearer term all technical signs are pointing to more pullback ahead. Given we’ve had now what looks like four weeks of distribution, for us to go higher and threaten a new all time high we are going to need to head lower first, aggressively, work off the excess as money is rotated out of hot money and into more stable stocks and then explode upwards.

Including 2022 and even Covid I cannot remember a market that has been caught this offsides by headline risk to the downside.

We had been rallying on rapid onset inflation. Garbage was flying because the potential 100x IRRs made buying them justified because we might see double digit inflation again. Everyone was going to be able to raise prices across the board and as the purchasing power of the dollar rushed to zero. Listen, we might still get that high inflation print, but CPI this month and the early indications of good inflation for June already not looking fantastic, that tariff tailwind into inflation isn’t here soon. This is honestly more bearish than bombs.

The garbage companies that have semi competent management all seem to think the party is over. Multiple ATMs were hit this week, cheap coupon converts were issued then upsized, and insider selling like crazy. The fattest hog at this pig trough was IONQ announcing a deal to buy a 5 year out (at least more like 20 years) pre revenue company using their expensive stock to fund the purchase and the less than two days later the CEO selling 100% of his available shares in the open market. Blue ribbon behavior by IONQ you gotta tip your cap to them.

In the last few weeks the market has become one where you either own completely garbage dumps of companies like ACHR, CRWV, JOBY, CHYM, OKLO, QBTS, space stuff, and yes maybe even HIMS or NBIS, or your account hasn’t moved much. That upside torque will likely rip someone’s face off to the downside as it reverses. For example, if the QQQ’s going down 3% next week or over the next two weeks, some of the names above will be down 30 - 40% quickly. Either by choice like ACHR, which is did a raise sending itself to 10, which likely will lead the share price down to less than 8 in the next few weeks, but with a longer runway, or just because the shorts have all covered in the case of NNE or LEU and longs wake up one morning finding out a portal to hell has opened up below them and they’re down double digits.

Until this downward pressure release resolves you want to be extremely cautious no matter how good something that’s moved higher looks near term. If the market is taking a pause even a small one that likely means Nvidia or Microsoft see some weakness near term. If that happens, I don’t think my long MU position is going to do well. Even though its bounced closed to 100% off its lows. And if I think MU might see some weakness I don’t want to think what downside might look like on more risky NBIS or CRWV.

I don’t want to fear monger. I don’t think we’re at the panic point yet. That’s likely more in Q3 into the end of funds fiscal year, but I think the by crap its rocket fuel period of the market is over, and if this is anything like spring of 2021 the withdrawals under a pretty boring top of the index were very painful for many of the rocket emoji darlings. The goal of the next few weeks will be to preserve your assets for what should be one more dash higher once we settle for a few days. You don’t want to be so worried about breaking even on a position in insert garbage here that you’re missing out huge everywhere else.

Some house keeping:

Normally in the weekend post I often send out some new ideas and updates on some older ones. I will still be doing that this weekend. It will be going out on Sunday. We’ll be discussing the dollar, oil/energy complex, Pizza, defensives and where I think the natural downside targets are for the mega caps the next few days/weeks.

Also if you’re a paid substack subscriber make sure to join the discord. We have a great community there and I put out (nearly) daily notes about the market and how I’m positioned for near term moves.

Last, if you have a youtube account check out Continuous Compounding, he’s a friend of the sleepystack and does these insanely long live streams where he deep dives into Japanese equities. Even if that isn’t your cup of tea, please consider tossing him a subscribe. Under 1,000 subs on YT is basically purgatory, they don’t care about and your videos don’t get sourced to potential new viewers much. Subbing on YT is free, and you don’t even need to watch his content. He just needs to get his number up. Plus he’s super smart, and I think gives a different type of stock market content (deep dives into Asian small caps) that most retail investors aren’t able to consume for little to no cost.

Talk to you all Sunday.

Thanks Sleepysol for the shoutout, really appreciate the exposure!

It is insanely hard to grow on YouTube. Let's continue to support each other's growth!

I gave Continuous Compounding a follow and also left a comment hoping comments also help with YT algorithm