Today’s Substack is split into two parts. The first is a somewhat stream of consciousness about deflation. The second is market talk. If you’re only interested in the market commentary, feel free to head about halfway down the post.

Since the great financial crisis there have been two times where the Vix has spent as much time above where it closed on Friday (37~) as it has the last seven sessions. There was Covid, and the worry of a double dip recession in 2011. That’s it in almost 20 years.

The idiom ‘once a decade type event’ isn’t overstating things.

I bring this up, because anyone who’s extremely confident about what’s about to happen is full of it. That includes me. I haven’t been less sure about what’s about to happen I think ever in my adult life. Or at least the part of my adult life where I had enough money to make money in the stock market. post writing note: trump blinked weekend market is up 2.5% as I edit this.

The market panicked last week on the tariff news. While I think the tariffs as they were rolled out were terrible, I think the market was looking for an excuse to collapse. The tape has been terrible for months, almost a year. Ever since Nvidia ripped higher on the stock split announcement and the mag seven peaked in late June, the market has been choppy at best. From the yen carry trade blowing up, to the Fed pause 3% bloodbath, to the Deepseek weekend bloodbath, to the random 3% down Monday two weeks after Deepseek when it was again proven ‘real’ to about five other days where the index went down more than 1.5% in a day on little news.

Obviously we’ve been in the down trend since late February, but in the tape the signs were all there before we started ripping lower. In the economy signs of the consumption slowing and outright economic deflation started appearing after the election. Illegal immigration started slowing which was causing a small consumption decrease. Travel and lodgings had gotten so expensive that people were forgoing flying, add in a mini baby boom that’s happening and now families summer plans went from travel to Europe to travel to the local beach. Meanwhile food prices staying sky high had led to people pulling back elsewhere. All of this was visible by just leaving your house and paying attention.

All of these trends came to a head this week when both the pre-tariff CPI and PPI report printed straight up deflationary. Not DisInflationary, DEflationary. A trend I was hoping we’d avoid but its here.

I bring this up not to brag, but to say I think the tariffs are a side show. Yes we're ping ponging up and down because the White House had a mess of a roll out and then walked some of it back. Yes I think that is negatively and positively impacting the market via sentiment, but I don’t think the tariffs were what the market was worried about as it was selling off hard in mid Q1. I think they became an issue post liberation from capital gains day. But I think the market was pricing in deflation. A trend that might not be over.

Deflation is death to an economy. It’s great if your job is recession proof, but for the rest of the working stiffs deflation means you have to work harder for the same amount of dollars.

Let me explain. Every year most people get a COLA (cost of living adjustment). This is often referred to as a ‘pay raise’ but its job is to make sure you don’t go bankrupt doing the same work and can put food on your table. So food (CPI) goes up 2%, you get a 2% pay raise. This is why boomers always talk about why you should buy over rent, because having fixed debt suddenly gets cheaper as your pay goes up.

If we have a period of deflation that lasts (lets say through the end of the year) and we deflation by 2%, companies will not cut your pay by 2%. You might either not get a raise, or worse, there will be layoffs. If you are a W-2 employee, I’m not trying to be hyperbolic here, keep an eye on your company’s financials if deflation takes hold. Companies will try to protect their employees as long as possible, but eventually they do need to make a profit. If they have to lower prices, that cost needs to get cut out somewhere.

I’ve talked about it in pass missives here, but earnings are made up of three parts. Company specific growth, industry or sector specific growth, and macro growth. The latter is often pretty much ignored, but if CPI and PPI continue to print negative MoM for a few months, every company will see slower growth and smaller earnings.

This a 10 year chart of Alibaba. Everyone blames the crash from 300 to <70 over two years on Jack Ma being disappeared. They ignore the deflation that took hold of the Chinese economy. Baba was growing *as a company* by 3 - 7% yoy depending on the quarter in 2022 and 2023, but the overall prints were coming in between slightly negative to slightly positive YoY because China was seeing 5% deflation. Earnings growth looked terrible, and therefore its multiple got compressed.

Tariffs and a fiscal war with China obviously puts a lot of pressure on Apple. What would put more pressure on them would be if they are unable to raise prices and in fact had to cut iPhone prices to stimulate sales.

Market participants like inflation, a healthy portion of it. Many market participants under the age of 40 don’t understand how bad long term effects of deflation are on the market. There’s a reason all the multiples in 08 - 2011 were so small.

Its not insane to think about a broad market with a mid teens multiple, or even as low as 13 or 14. This has happened before during similar periods. Its one I hope to avoid.

Its also why I continue to believe tariffs are mostly a side show, and why the Vix is so stubbornly high.

The market needs a signal not just from the Fed but from the White House and Congress that spending is going to start soon, and that rates are going to get driven into the ground. The longer they don’t get it the more confused they get. The most confused they get the higher the vix remains.

The issue is the fed can’t cut, because they made some political cuts prior to the election to try to front run the deflation. Cutting was fine, but the speed and glee at which they did it made it impossible to continue the moment Trump won and suddenly collective wisdom said he was going to be inflationary.

But cutting won’t help much, as the 10y doesn’t have a lot of inflation priced in anymore, as I wrote about here:

Defensive sectors, long bonds, and Q2 preview

On Friday I put out a video talking about how the most recent PCE print was starting to point towards deflation. Deflation freaks out the stock market, as it destroys a lot of built in growth especially for larger cap companies as they are ‘more mature’. Without that inflationary tailwind, valuations need to come down, especially for long duration (tech…

TIPs actually had higher yields on Friday than they did on Monday.

So the fed is in a pickle. Then you add in a White House that wants cheap oil and is at least paying lip service to spending cuts, more deflationary pressures. Its a mess.

Deflation is the most important topic the next few months. Keep an eye on it. As unless this beast is slayed soon the market is going to be weak.

Now that the deflation rate is out of the way. Let’s talk about the market. With it rallying 5.7% after a nasty week lower it seems like we’re out of the woods and the worst is behind us….right as we’re entering earnings season.

We are now no longer oversold on the index level, and while things seem to be firming up when we’ve rallied off the lows like we have on an oversold bounce as we did, more than 70% of the time we ended the following week lower by at least 2%, with the worst being -8%.

Here’s what I’m seeing with ES (which I don’t trade but it’s cleaner because it has the Sunday night low on it):

The good news is we’re making higher lows. The bad news is there’s either no buyers or a big seller above us. The 4800~ low was made Sunday night on huge volume, but not during a cash session. Nor a premarket/post market close enough to a cash session to allow for non futures traders to participate in it. During the ‘18, ‘20 and ‘22 bear markets the lowest point was all made during either the cash session or a gap down on bad economic data an hour before the open (in the case of 2022). It would be rare for us to bottom on Sunday night.

I think we’ll know what’s going to happen next within the first two sessions next week. We’ll start hearing from more banks, and who knows maybe the White house puts out some good tariff related news to break the seller. But I’m cautious.

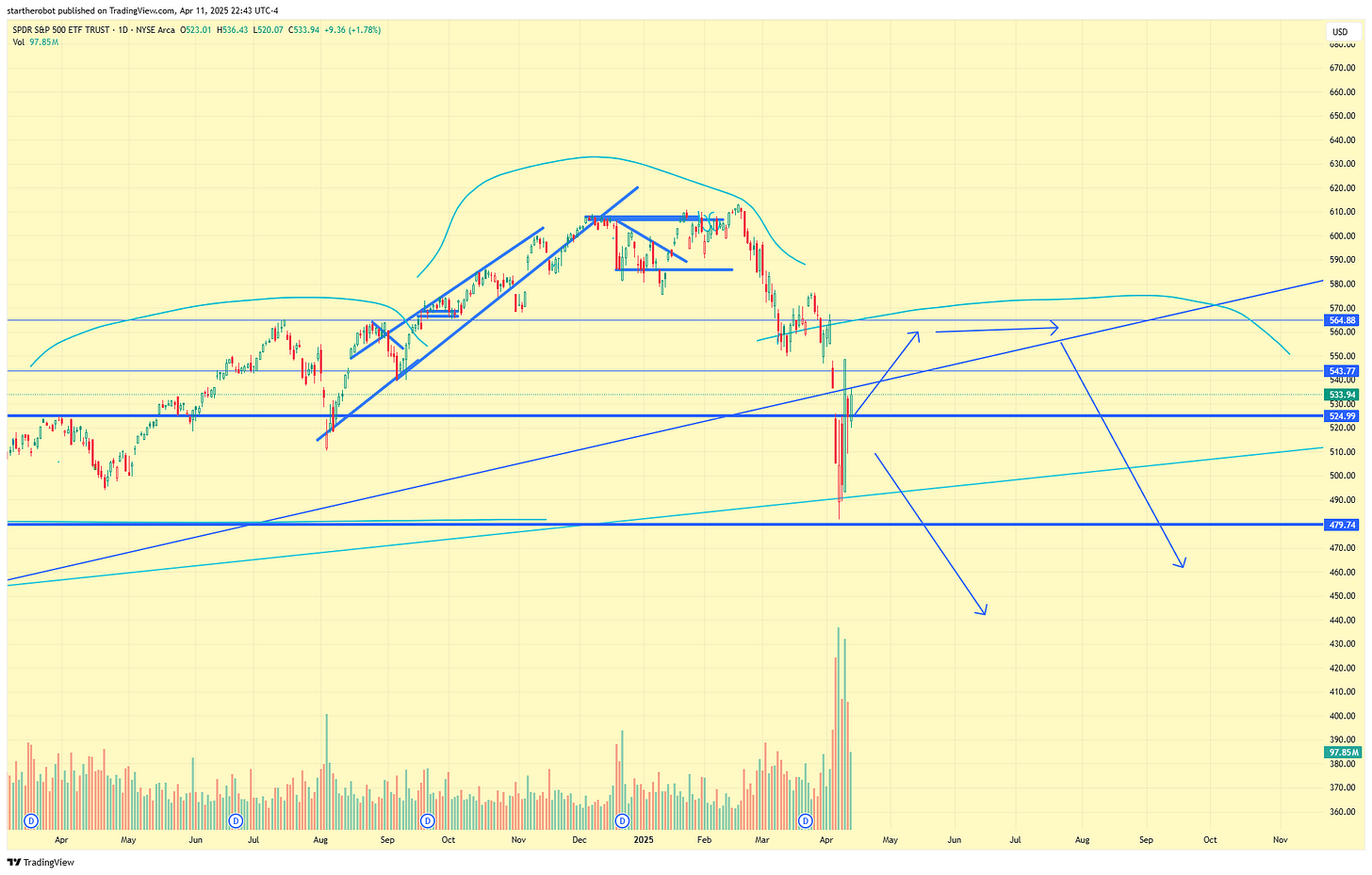

Flipping back to SPY, I have two paths that I think are possible.

The first is we break down below the 4800 level quickly, maybe as soon as next week. On another huge washout. This creates maybe not the lowest point we go, but enough damage that now we’re done. Now its time for some sideways action before heading higher in Q4 and early 2026, likely to a new ATH by mid 2027. In this situation some tariff announcement likely sends us lower, or some bank CEO next week talks about bad deflation is for the market.

The second path is what I call the ‘right shoulder path’. We made a massive H&S pattern rallying up to 560/565~ and sticking there for a week or two. Then we get our huge washout and head back to either 4800, or 4400~. The way I see this path working is the market ignores earnings this quarter and then rallies on some tariff deals or walk backs. Then as we get through the midpoint of Q2 deflation has gotten worse and noticeable to everyone and then panic sets in. Worse than what happened last week.

Ignore the timelines on the arrows I made them longer for affect. I think if we’re getting the next leg down first it’s going to happen soon. By end of the month or early May. Otherwise higher first.

I think the bottom of both paths is at least 440~ on SPY, with an outside shot of a double bottom at 380.

Either way, keep your longs tight.

Its really hard to look at the market structure of this week and think we’re done with the downside. But more importantly than that is the recovery. This one likely won’t be a V bottom. In fact, any V bounces like we had this week should make you nervous, as there isn’t enough intra market rotation to figure out what would do well/weak in the new world order. Either from a tariff POV or a deflationary POV.

As the market continues to move up and down with every stock having a beta of 1, its hard to say ‘we’ve bottomed’. I might be proven wrong on this, but unless the fed announces that they’re buying 100b a day in bonds, or until we get another massive spending bill through congress and signed by Trump, or until he and China find a path forward, the market seems unstable.

So what am I buying. I’m still holding to my list I made last weekend:

Doomsday stock market shopping list

In this weekends post I’m not going to spend time talking about the tariffs. I mostly recapped my thought about why Vietnam is the most important Tariff that the market freaked out about in my live stream. the TL;DW is that China is in the biggest bind and its now a global game of chicken, I don’t think Trump will blink first.

As some of these that did hit, like Shopify, Nike, Bank of America (and then MU and NBIS) that we bought did very well. I’m still waiting on others as they get there.

Besides that I want to talk about two sectors.

Keep reading with a 7-day free trial

Subscribe to Sleepysol’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.