Lower highs and bullish engulfing, what to make of this weird stock market?

We're now live on Discord!

A quick housekeeping note before I being. I’m setting up a discord to make it easier to communicate day to day. The link is below in the paid section. I am trying to find a way to allow regular members in as well. I will keep non paying members updated on this if any changes are made. Check it out below!

The week of the market was one of headaches. In both directions. From Monday’s overly aggressive puke where nothing worked, to Wednesday’s panic buying, where everything worked, it was a week of whiplashes. If we weren’t less than 3% from the prior all time high, I’d write about how I’d think we’re close to a bottom and to start finding deals to long.

We’re not. Or that is, this everyone out of the pool- now in the pool- now out again- no wait IN IN IN, is a sign of structurally higher vol near term. Even if its not showing up on Vix prints. This is neither bullish nor bearish, and the aggressive move to the upside in the latter half of this week (and possibly into early next week) was built into both the two bear cases and the bull case I laid out for the indexes last week.

The instability in the market could lead us higher first. We could make a new all time high, no one fully knows, but historically it usually resolves itself either via time (flat market) or via new buyers stepping in (market going down). Instability is a hallmark of bear markets, as all of best days in the market have been during bear markets periods because of position instability. That doesn’t mean we’re in a bear market. Only that we need to start worrying about possibly coming into one (or that we’re already in one that started in early December).

On the bullish side, after seeing what felt like two maybe three green days in all of December value/low beta/RSP have all rallied since late last week, starting to out perform the S&P 500 ytd. This is a trend I expect to continue. Energy, parts of Uts, and Materials are all on ‘theme’ for this year (more on this below). With Trump coming in wanting to deregulate things, banks all look good (ignore insurance). Staples have gotten beaten up enough with bond yields rising that many of them are trading are low enough multiples that long term buyers have started showing up for the mid-teens IRR and potentially explosive upside if the dollar rolls over.

This move up in the rest of the market helps bring the floor higher for when tech stops looking terrible. Which, depending on what you think of the near term prospects of AI, might be a bit.

I think the next week will be a great time to start hedging some off these risks off, more on this below.

Earnings this week were very strong. If you were a bank. The non banks had less good earnings and poor reactions to those okay earnings. UNH earnings were a beat, affirmed guidance (aka we don’t want any bad PR about record profits right now) and finished the week slightly down. Lululemon pre announced stellar earnings, but apparel is out of fashion right now, with ANF down 25% on the week on slowing growth, bringing the whole sector down with it (and possibly providing a future buying opportunity for RL and VSCO). So Lulu also ended the week lower. As did most consumer facing names.

For the banks, the strength of their balance sheets, coupled with the massive amounts of cash in the system, and the hopeful tailwinds of Trump removing the worst parts of B3E from the system all point to the major banks re-rating higher. Even Citi! None of them see a recession coming in the next quarter, but are all building up war chests in case one appears in the latter part of the year. Banks, at least the big ones are a lot less cyclical than they use to be. Near term unless Trump announces that B3E is back on and possibly worse, their isn’t a huge amount of near term risks to the money centers.

This is less true of some of the regionals. Which had themselves a day today. Broadly, they would really like rates to be lower. Especially the 5y and 10y. That will give their CRE exposure the ability to refi and take some potential write offs away. I’m not a buyer of any regionals yet, but I think that they’ll be a steal starting in late Q2 for a solid rally in the back half of the year once we bottom out on bonds. They’re already rallied somewhat on the chance that the long end bottomed earlier this week. If recent buyers are right, then I missed the boat. I’ll catch the next one though, as well need is a random Trump tweet to cause a minor amount of chaos in the bond market for all the regionals to get cheap real fast.

Speaking of Trump and his admin, one of the easiest ways to make money in the market is to figure out where the government is going to spend money and long that sector. An easy example of this was water purification companies, like TTEK early last year as the municipalities were all using their IRA money to clean up their water supply before they had to give it back. This also worked with MSI and AXON over the last almost three years. All huge beneficiaries of the muni spend in the IRA bill. All else being equal many of these names are better shorts than longs right now because the multiple expansion will not be backed by as much earnings/backlog growth as they had in the past.

Saying that, pieces of Trump’s admin were in front of Senate committees this week and no matter what department they were heading off to run, one topic kept coming up, energy. Whether it was our near term energy needs, how Russian war ending would affect energy consumption, China’s energy production being dirty (coal) vs green, or any other sub topic, it’s like somehow in the last six months I stepped back in time to doomer forums from the 2010s on how we were reaching peak oil and everything was going to skyrocket in price because energy costs were going to explode.

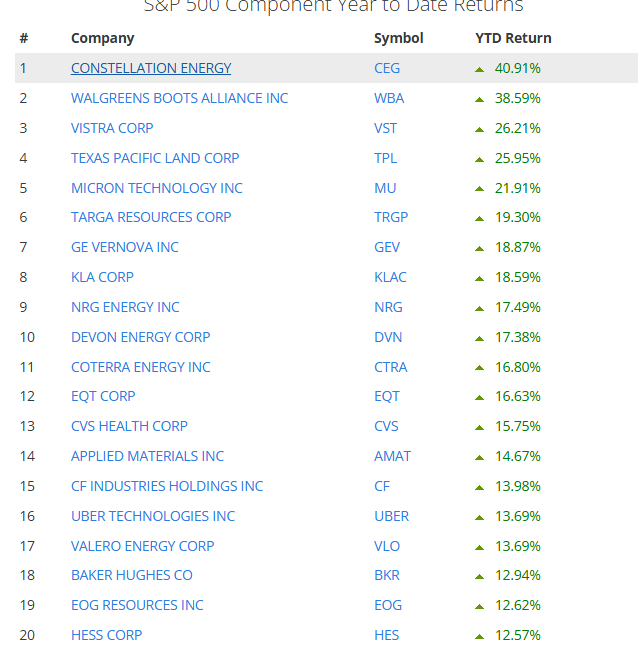

Except, its not just doomer preppers now. It seems to be everywhere. Everyone in every company seems to have mentioned energy costs….except for Nvidia would just keeps telling us to buy more of their chips because eventually they will product enough energy themselves that we won’t have the need for any other company to exist. Investors seem to have taken notice. XLE is one of the best sectors, everything natural gas related is up a lot YTD, like double digits a lot. CEG is the best preforming stock in the index YTD. Even with a fire at their plant VST is still third. The top 20 list YTD is littered with Energy names.

I count 14/20 names are somewhere in the energy complex. While this isn’t exactly like 2022, its rhyming a bit.

Unless something changes in the next 10 days when Trump comes into office, energy will continue to be THE place to make money at least in the first half of the year. Further helping matters is that ex-VST/GEV/CEG all energy names are trading at absurdly low valuations. Historically low if you exclude 2020.

This is still true after low double digit returns in the first 17 days of the year. It will be less true 30% higher, but still true-ish. That’s when suddenly the momentum people, nursing their up 3% YTD in May portfolios will rush into Energy to try to capture upside after being burnt by Tesla for the 15th time and that’s when it’ll start being time to sell. Especially the NG/Oil producers. Especially if they’re not hedging ‘because they see prices higher’.

On the nuclear side, NEE traded at 40x NTM earnings for years. This was when ESG energy was alllllll the rage, and it was a core holding in every portfolio as one of the few ESG profitable companies. I don’t think CEG should be even considered a sell until it trades at 40x NTM EPS for awhile. Now, saying that, it screens expensive right now because of the M&A with Calpine. According to management that will add 2b in annual FCF immediately upon close. So the market is already starting to price that in. Given that, plus that their base growth of 15% when CPI is >3%, you’re looking at a company that’s fluttering with 28 - 29x NTM earnings. Which again, expensive compared to its sector but not insane sell levels of 40x that we want to see (and it will get to).

I think its not insane to think CEG hits the mid 400s at some point this year. The market is finally starting to realize how great of a company they are, how well it run, and how needed nuclear energy is going to be.

The whole nuclear space is worth looking at. Next week I’m going to send out a dive on all of the uranium mining stocks that worth looking at. Not just CCJ.

But yes, Energy and Banks are looking good this year. These are names you probably want to be long and buy on dips.

Before we talk about what doesn’t work, I wanted to do some quick odds and ends on random stuff:

I’m watching PTON. The sell off today was less than ideal, but there were so many BTO 9/10/11 strike calls for today that it made sense that because we weren’t over those levels the stock was going to puke. On no volume and very mechanical selling it’s clear it wasn’t someone big trying to dump their position. There was some netural-ish news about web traffic being down for people looking to buy their hardware, but all consumer facing stocks, from the momo names like WMT/COST to apparel like the above mentioned LULU/ANF and others all sold off this week. So it wasn’t fully localized to just Peloton.

A little more worried about this dumb Friday before a long weekend lawsuit by DoJ against WBA. Stock is down 8% since it was announced. Hours later WBA still hasn’t released a comment because again, half their corporate staff is probably on vacation right now. Will be interesting to see their response, but I imagine if this is a nothing burger and the price stays low then it becomes an M&A target again. Or the market bids them up fast. Just annoying though.

RL looks interesting on weakness before earnings, send tweet.

MU looks like the only half way decent new tech long in the market right now. I would like to get long at 100~ let’s see if the market sends it there.

VST fire is one of those events that we won’t know how bad it is until its late. Either VST was on sale today and its going to 200+ quickly, or its going to puke down to 150~. We’ll find out likely after we miss our moment to sell/buy.

Intel will get a Trump bump in the next few weeks because of the build America/buy America play. Other names that build America/buy America like CARR, DE as an agg proxy. Even more so than it did today. For anyone who followed me on those Intel June calls, I will be selling on either a massive IV spike higher on a Trump esque headline or 25+, whichever comes first.

VALE looks very cheap here. 10% dividend. Major shareholder finally threw in the towel. Stock went up on high volume. Decent risk reward.

China saw a bunch of dumbly bullish flow (BABA 110+) for June. Not chasing it, but want to note it here as notable.

Nintendo announced the switch 2. The market didn’t like that its not getting a full announcement until April, when everyone was starting to price in a release in April. It will recover.

Okay, let’s talk about the broad market. A lot of bulls are going to spend the weekend talking about the bullish engulfing candle on the SPY weekly.

I think you need to be very careful. While the body was better that last week’s we still didn’t make a new weekly high. Putting in another lower high.

You don’t even need to use a tool and can free hand the lower highs on the QQQs.

The mega caps make up 55%~ give or take a point depending on the day of the QQQs. They make up 30%~ of SPY. The days they rally the market rallies, the days they fall the indexes fall. Like Thursday, when the Apple and Tesla were throwing up but 70% of the index was advancing on the day. The market fell on the day.

The concentration of names at the top is bullish when they’re all going up, but MSFT and NVDA have been flat for months, Apple looks like it’s not going to stop going down until at least 215~ and maybe even lower, Tesla is doing Tesla things, and stuff like Meta is trading on SCOTUS headlines, which is something you really don’t want to see if you’re long for fundamental reasons.

At the core the mega caps are struggling because AI is struggling. In the last two weeks we’ve seen Microsoft announce they’re switching to a consumption model for CoPilot, because no one was paying for subscriptions. We’ve seen Google announce they’re forcing their AI assistant onto their business tool’s users and charging them and additional fee for the service (supposedly this has led to some light cancelation threats, so we’ll see what happens). Apple AI is probably one level above disaster, but hasn’t seen any significant replacement cycle uptick and in fact are losing share in China (down 25% sales yoy) and barely holding on in NA. Best buy also said the AI assisted PC sales were worse or equal to non AI PCs. Consumers are mostly meh at best on AI right now.

Further damaging the bullish all things AI w/r/t stocks, is that Nvidia spent time on their CES show to talk about the next hype thing, Robots. (which as an aside will take years to spool up because of the huge amount of manufacturing that needs to go into creating factories to product robots, the market will not miss that pivot like it did with AI). They also spent time poo pooing Quantum computing stocks.

Then this week, they announced they are having a Quantum day…next month I think. Microsoft also announced something related to Quantum. In fact the only company that didn’t push out anything quantum related in 2025 is one of the leaders in the space, Google, or IBM, or Honeywell. They’re not hyping anything because they realize the qubits are nowhere close to commercially ready. That’s not stopping Microsoft and Nvidia from using it to pump the hell out of their stocks.

Listen, if I had to pick mega caps to bet on being lower a year from now the top two would be Apple and Tesla. The next two would be Microsoft and Nvidia in some order. The fact that we’re only 6 months removed from some the business commercial releases of AI and they’re already starting to pivot towards the next best thing speaks more about what they think the near term successes of AI/Data center growth will be than anything any bears can say. I’m not arguing that the tech isn’t real, or that these companies would be higher at some point, but they’re both trading at premium multiples because the assumption is that AI, or creation of God (if AGI happens soon) is omega bullish and nothing is standing in their way. The companies are acting like ‘yes there is something there, but its not as bullish as promised’ and they’re hoping that the hype of the next hot thing will offset the lack of near term results.

Microsoft is either building out the nicest base ever and about to launch to 5tril market cap, or a massive amount of long term shareholders have used the last year to exit their positions.

Its hard to look at that chart, and the chart of Apple, and Tesla and the flatness that Nvidia has had for the last almost 9 months, and really look out at the next few months, given the instability, and be uber bullish the broad indexes.

I listed how I’m hedging some of this risk below the paywall, but I wanted to finish with this. Be careful. Even though we’re above some of TA moving averages that say be bullish, this year has already shown to ignore a lot of those. Its better to make a few less bucks on an up day but lose less on a down day. Until we get through this period of instability, survival is goals A, B, and C. Making money is secondary to surviving. I mean that unironically. If you’re not comfortable holding a position down 20% set a stop.

Because even though I’m very bullish the energy complex, if Apple goes down to 180, or Nvidia to <90, Exxon or any other energy long will not stay up alone. They might not puke, and might only go down a little, but everything has a beta of one on the bad days of a bear market. So stay safe when it gets nasty out there, and keep a little war chest to tap into when it gets really bad as it did last Friday. Then you get to go long before the market rips higher, and hopefully outperform.

Keep reading with a 7-day free trial

Subscribe to Sleepysol’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.