Sunday afternoon market thoughts

China, $TRUMP COIN, and some discussion about Earnings this week

General housekeeping before we begin: Please let me know in the comments below if you’re having any issues with accessing the discord channel.

My wife told me this morning that a bunch of the influencers that she follows are FREAKING OUT right now over the Tiktok ban. Some of them are confused as to what’s going on, others are bemoaning the huge (in their eyes) completely unexpected loss of income. Their reaction just lays bare how you don’t need to be that business savvy to make it as an influencer. You just need to have the right ascetic and be one of the lucky ones that one of the various algorithms pick to elevate. That gives you a base to build an audience off of and eventually pretend you were some huge ‘marketing genius’ when you more likely were in the right place at the right time (with the right ‘style’).

Trump’s actions the last few days have laid bare what his goals as well. At least with regards to China. He’s been all over social media and interviews trying to ‘save TikTok’. Or figure out a solution for it. He also wants to travel to China (and likely make a deal) as soon as possible. This all points to the huge China bashing he did in the first term to be somewhat a thing of the past. At least when it comes to trade. Which is odd, given what he wants to accomplish re: tariffs, but maybe its because the CCP is in lets make a deal mode. They would like the rest of the globe to come back and subsidize their growth via investments. I’m not sure what this means for Chinese equities near term, but I continue to believe that they’re worth allocating some money towards. Either via HK listings or international companies with Chinese growth like Lululemon. I will continue to own my Tencent and Trip(dot)com (TCOM).

As an aside more near term a lot of calls all over China has been bought to open about 20 - 25% OTM for May - July strikes. My sense is those are less CCP specific action or their domestic economy improves greatly kind of buys and more related to Trump signaling that he’s going to slow/pause the China bashing and therefore some of the geopol risks, especially the big one of delisting, gets removed. I’m not long any new Chinese positions because of the options action recently. Just wanted to point this out.

A sentiment shift in China would be a bigger buy the news type event than what happened last September. Even though that event will likely have more concentrated gains.

Besides the China news, we have Trump coin. Not going to waste much digital ink on it, but I will say that all else being equal I would rather have the people in the white house/elected officials making money through naked public grifting instead of selling access and foreign contracts like family members of various elected officials have done in the past. While I assume all the talking heads will be gushing over it, either positively or negatively, in the next few days, the only thing I really think is that the moment TRUMP breaks, it likely spells the end of alt season for crypto and alt season usually happens last in the bull cycle for Crypto before a nasty pullback. I think that’s why a decent amount of crypto people I follow are despondent about TRUMP. If crypto keeps the same pattern as history, it likely points to BTC <60k if not low (50% draw down) before much more meaningful (20 - 30%) higher. Suddenly a lot of people who’ve been in the crypto space for a decade plus are realizing the bull market they thought was going to last until Q3/Q4 2025 might be over midway through Q1. That’s not good- for them.

Onto earnings. This week is still somewhat light because of Jimmy Carter day 10 days ago, and now MLK day tomorrow. Next week (the week of the 27th) is going to be nasty as it feels like every company is reporting.

This week there’s two very important companies reporting which should have outsized affected on the market, and a few other companies that I’ll be paying attention to.

On Tuesday morning 3M is reporting. There’s no real way to buy the stock pre-earnings but I expect a move up to the mid 150s on the strength of its consumer division and possibly a guidance increase (mostly from demand in LA due to the fires but they won’t say that directly as its in bad taste). The stock has broken out of a six year long downtrend after finally cleaning up the lawsuits and other issues. I don’t expect a lot of aggressive moves to the upside, but buying 3M on dips in the future should be net positive to your PnL if you’re comfortable holding what should be a boring steady grower.

On Tuesday afternoon we have United, which I expect to do well and still think it gets to 156~ by mid to end of summer, and Capital One.

I don’t own any Capital One, but I own a lot of Discover. Now that Trump is in office the assumption is pretty clear that the DFS/COP merger will happen any day now. The spread on DFS shares is about $5.5 to the merger price. COF management team is one of the best, and given what the money center banks reported there’s not a huge amount of unknowns to Capital One’s earnings. Saying that I will be listening to commentary trying to find out when they expect the deal to close. I’m hoping its within the next few weeks.

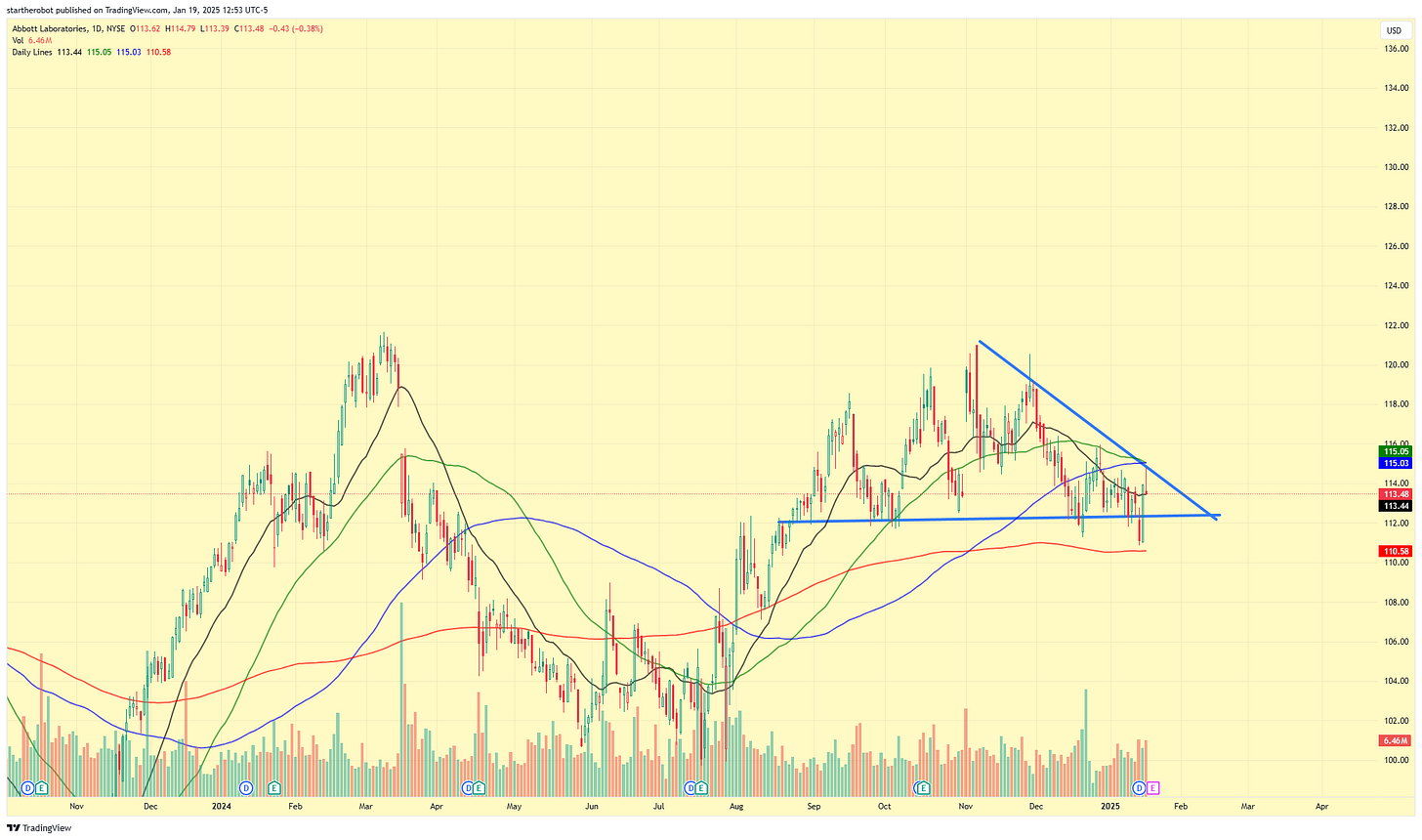

On Wednesday Abbott Labs reports, the market is expecting $1.34 in earnings, and the whisper number is basically that. ABT has done nothing since 2020, though recent price action does point to be slightly bullish. Saying that it’s not exactly cheap even with its sideways action at 21x NTM number and expected growth to be right around 10%. Their product pipeline doesn’t look fantastic in terms of massive revenue surprises, but who knows. Healthcare has been beaten up the last few quarters, but if any of the sectors are going to jump start the recovery it should be medical devices. Plus given that Ozempic is starting to get some negative press due to some side effects, it wouldn’t stun me if investor sentiment pushes this name higher on a slight beat. Something to watch.

Two year chart of ABT:

The other healthcare name reporting on Wednesday is J&J. They are historically very cheap, like <13.5x NTM cheap. They just need to show growth….somewhere. The market loves J&J it always has, it just needs a reason to buy it. J&J was one of the best large cap healthcare/pharma names this past week because they bought Intra-Cellular Therapies for $14.6B, and the market thinks they’ll be able to use this to jumpstart the growth pipeline. They too have a medical device division which again could see a re-rate higher. The market is expecting $2.05 in EPS for Q4. I don’t think Q4 matters much unless its a wide beat/miss, the market just wants to hear how they can get back to high single digit revenue growth so they can slap a 18 - 20x multiple on it and rip it up 50%. Until that time, JnJ is going to be painful to own.

Last on Wednesday is GE Vernova. Another energy complex name. This stock is up 300% since its IPO/split off from GE. I think it wants higher just because its on theme this year. Energy and power consumption are going to be THE stories this year, and I think this is a trend that will continue until at least this summer. I bought some GEV on Friday instead of adding to my VST position. Its a small position, but I’m happy to own some of GEV if it rips into the 450s (and happy to buy more at 350 if the thesis didn’t break).

Okay now that we got the odds and ends out of the way, lets talk about the two companies I will be watching the closest.

Keep reading with a 7-day free trial

Subscribe to Sleepysol’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.