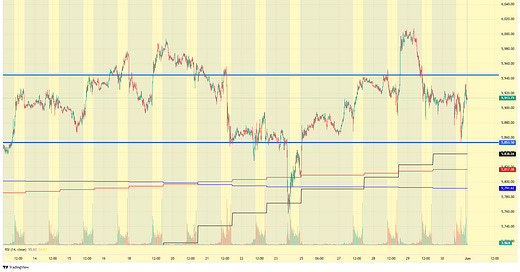

On an index level we haven’t moved hard in now three weeks. Dispite huge chest beating by bull and bears saying we’re peaking.

This points to a huge move coming, upside break → new all time highs very very quickly.

Downside break on the other hand gets nasty. 5600~ is the obvious first place we’ll go, but don’t rule out 5200 Easter level.

The reason I lean slightly bearish here is info tech had it largest net buying this past week since the covid low, mostly on short covering, and even with that being the largest sector in the market the index could not find purchase higher.

We could still go higher but it’ll be on the back of trade headlines and likely will be short lived unless its solid progress with China or the EU.

Saying all this as I write this mid day Sunday BTC is flirting around with 105k, which is roughly where it was at the end of cash session on Friday. This points to the early days of June should be muted, so more sideways.

With this week being software week, and the big name being Crowdstrike, if Tuesday’s nights AH action doesn’t move us materially out of the range the market has to hope that the macro data at the end of the week (jobs) pushes us one way or another.

I don’t have a lot to say about earnings this week, everyone and their mother are long crowdstrike but it also looks like it wants 600 within the next quarter.

Outside of that, Braze seems cheap but not sure how it moves, same with docusign. Both are Thursday afterhours.

MDB is Wednesday after hours, everyone is very bearish on this name and if their earnings aren’t heading to hell levels of bad, this should see some incremental buying post earnings because its been beaten to hell. I’m not sure how sustained that buying will be though.

We also have S&P inclusion this Friday after hours. The committee threw a big curve ball by putting COIN in after DFS was removed, fins were the obvious sector to target for this Q, but now I’m not sure which is why I’m not writing up any ideas. ZS and APP are probably both still on the short list but I wouldn’t be stunned with another energy name even if they did one last quarter. They also moved GEV to industrials from utilities. Which points to them not adding an industrial this quarter.

Anyways the theme of this week will be to not be very aggressive in either direction but to push hard in either direction once the market moves either way. It will be violent, the goal is right now to stay safe and solvent.

Discussion about this post

No posts