Updated thoughts on Reddit, Hasbro, and Honeywell

With the broad market in suspended animation and not a lot moving. I wanted to use this pause to do some thesis cleaning on some of the longs I pitched 6 - 9 months ago, Hasbro, Honeywell, and Reddit.

Let’s start with Reddit, as that’s the most impressive one in the last few sessions. They announced a new AI feature on Tuesday, coupled with being the only major website to see visitor growth in the last few weeks was a one two punch that put bears on the ropes. The bear case, slowing user growth and potential AI risks as people move away from google, makes sense when the stock was pushing 250 a share. That same thesis was being thrown out there by people who make their living commenting about TMT and social media stocks when the stock was between 115 - 120. At those prices with roughly 15% of the market cap going to be in cash within a year, even user growth staying positive or management executing on growing arpu would’ve sent the stock materially higher. Which happened on Tuesday when it ripped up to 145 as an intraday high before settling a little bit. Up almost 50% in a month.

The short term story on reddit has gotten murkier. Which again is a lot more impactful when the stock is 2x higher. That hasn’t really affected the longer term case at all. In fact, since I first wrote up Reddit when it was in the low 70s before earnings in October last year, the longer term bull case has only strengthened.

Reddit is the end of the internet. Well AI is, but Reddit will be one of the last places standing. This might be hard to understand for people under 30, but at one point you use to have 20+ websites you would visit regularly. Random people’s blogs, forums on topics you were interested in, and other odds and ends places on the web. That’s why Google was so powerful, there was no place to figure out how to find information on the topic I was looking for. Heck Wikipedia and Microsoft were going head to head to see who was going to be the dictionary of the internet.

Twitter started getting big in early ‘08 during the Obama campaign. That was the beginning of the end of the blog world. As the ADHD of many blog writers was settled by sending quick tweets vs long winded essays about their lives or thoughts.

Digg was a competitor to Google or at least trying to be. It’s goal was to index things under specific groupings. So you didn’t need to search video game news or science updates, to find something, it would just be under its category (video games/science) which would help you learn more, faster. At one point right after google IPO’d people were talking about Digg being the next big thing, as it allowed websites to post their own links, this helped grow their site growth faster and increased their SEO rankings asap. Think of it like an on ramp for SEO victory.

Without going into too much detail, Digg’s management eventually screwed up bigly, ticking off its power users who posted news stories a lot and then ticking off the average visitors. Enter Reddit.

Reddit became the place people deposited stories into and discussed them. What started as a Digg replacement has slowly replaced all the internet forums. The biggest single topic forum, the World of Warcraft/blizzard forums, stopped being the place to get new builds in the early 2010s, as people would post them to reddit first.

So what use to be 10 personal blog visits you would read regularly, became spending time on twitter. What use to be 10 forums you use to visit from a variety of topics became reddit.

4chan fits in there as well, but that’s mostly for people neck deep in debating waifus and video games.

These moves have shrunk the internet, AI would like to continue shrinking it by further removing sites you’d end up visiting. Why type in a bunch of symptoms into google and then visit web pages about what is wrong with your dog/plant/cough, when OpenAI can just post a detailed answer with a range of outcomes. This works for cause and effect things like why your plant might be dying, but it does less well when things are changing, or evolving. What’s the best place to eat in XYZ can’t be answered if no one on the internet has talked about that topic recently. As the real world evolves AI will need new information from real space to make new outputs. For hype specific company AI people will be hired to adjust the information as needed, but for search AI, it needs some new information dumping ground to source from. Be it, twitter, Facebook, Tiktok, Instagram, Reddit, or 4chan. Given that Meta owns facebook and Instagram their data likely will be walled off. Twitter is owned by xAI so same. That leaves Reddit or 4chan as to where search gets their new information.

Given the general distain for 4chan, Reddit becomes the clear winner. With AI reels now every 5th video and AI tictok videos being every 3rd video you watch, the internet is getting lonelier. That doesn’t mean reddit won’t see more bots, but being a text based platform focused on breaking news in various subjects has less push pull content because of bots. They are an issue, but one that is less clear an obvious as it is on TT and insta.

The long-term view of Reddit at 140 is one of strength, as long as their user growth and page visits continue to trend up their revenue will eventually follow. Even if ARPU stalls out short term. As long as numbers are positive this stock is heading much much much higher, as until proven otherwise they will be a survivor in the post AI hellscape that will be the internet.

Shorter term, that’s the unknown. If user growth stays growing at 20%+ yoy then it should quickly trade up into the 200s, as the high gross marginal dollar of every new DAUq will shoot EBIDTA and FCF through the roof. The more this number stabilizes higher the better the short term picture is. The more unstable this number is, the more the stock will continue to be jockeyed up and down by short term traders.

That doesn’t mean you can’t make money on the push pull of the stock on a day to day basis, but understand that it has a tight float and any negative noise will lead to the stock being attacked as a melting ice cube.

My personal view is Reddit should be around 160 given where the numbers are right now. That’s about 14% upside near term. As for the future, I think as the sixth largest website in the world that is just now rolling out its international expansion plans, it should be multiples higher than it is now in the future, once the near term noise is worked through as Reddit becomes the default source for every AI model.

Honeywell:

Honeywell earnings continue to be fine, not very impressive but fine. The more interesting aspect continues to be the break up of the company. At 220~ I think there’s still material upside here. When I wrote up the sum of the parts valuation back in early Q4, I had a 250~ price target on it. Within a few weeks Honeywell got an activist investor who came in wanting to break up the company and the stock rallied on that news to…242 before falling back into the same range it’s been stuck in for the last four years.

This isn’t a name you have to rush into, but its a name I like over the next few months especially if the market starts dumping. As we’ve gotten more data on what the split up of Honeywell might look like, the SOTP valuation has ticked higher and I don’t think its impossible for Honeywell to see 290~ around the end of the year. Honeywell owns about 50% of the leader in the quantum space, they have a profitable space division, they’re in med tech, war stuff, automation, natural gas and other energy areas, parts of robots supply chain and so much more. There’s a real possibility that much like how GEV became the surprising success story of the GE split up, that one of the non core areas of Honeywell rockets higher as the market realizes that everything that’s sexy in the market right now is present in one of these spin offs…. and is profitable.

Image if Honeywell puts their war division with their space division with parts of their robot supply chain team. Given the multiple that some of these non revenue generating commands on 2029 numbers, this piece of the business should be an instant winners. Who knows.

We should find out more in the next two earnings calls, I still hold a solid position but am an added to that position on the blue uptrend line until we get into and through September. Where it’ll be put up or shut up on my long Honeywell thesis.

Finally, we have Hasbro.

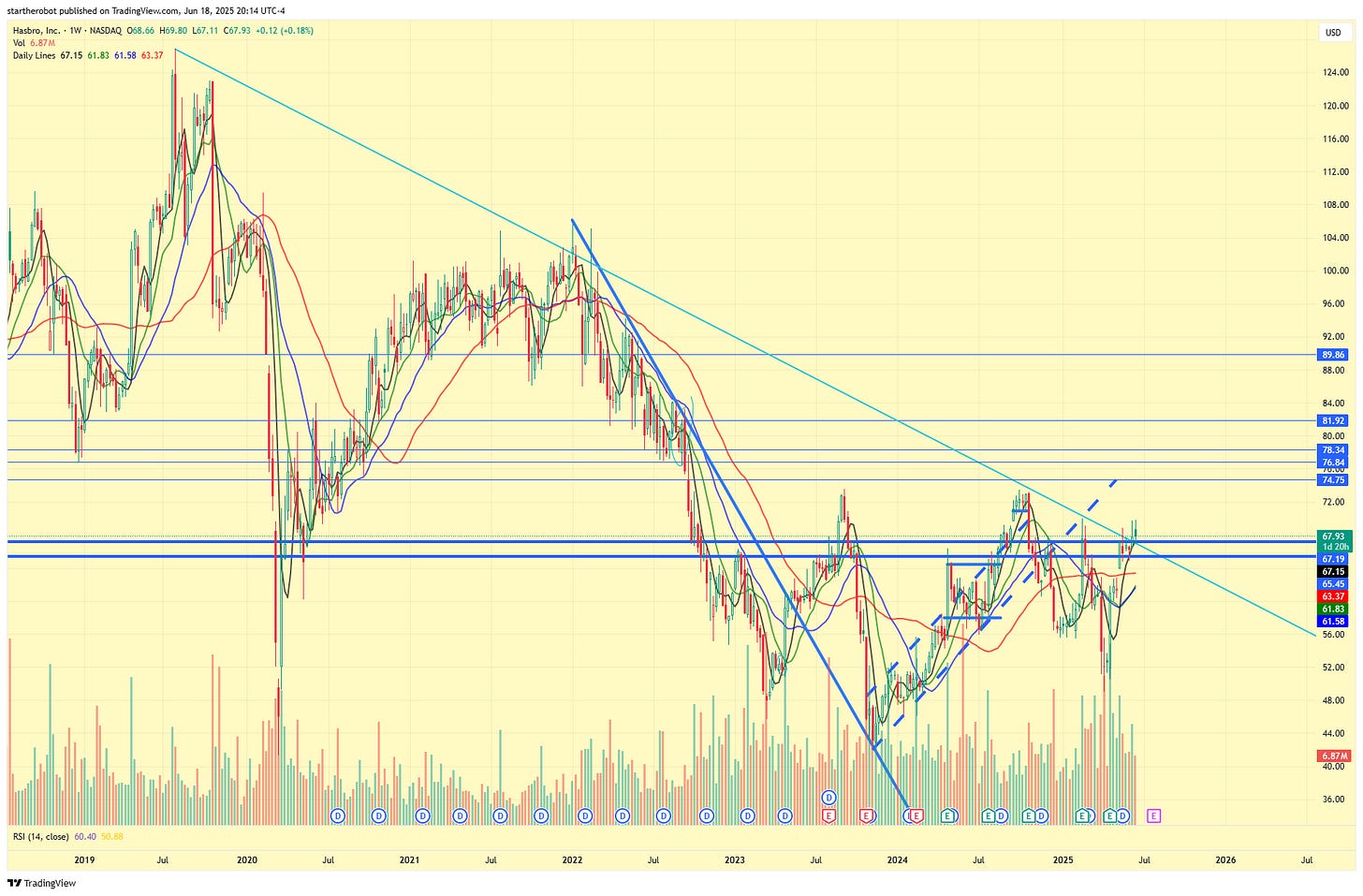

Hasbro continues to be extremely cheap at less than 14x NTM EPS. Their video game releases are coming soon, and should start appear in the guidance in Q3. Not to mention Final Fantasy MTG has been their most successful release ever and should help surprise EPS to the upside. With a 4% dividend and likely a buyback announcement coming within a year, there’s a decent return to shareholder value here even if the price doesn’t move higher. I still think it sees 100 by EoY or early next year, as the video game EPS and revenue growth makes the market realize this stock is stupid cheap and should see a 20x multiple. On 5.5 - 6 in EPS in 2026 you get a 110 - 120 share price.

This is a sleepy stock, as in the market doesn’t pay attention to it until earnings. I will be buying move as long as it holds the breakout level (chart below) into earnings. This is a stock that has every reason to go higher, just needs the market to realize it.

Hasbro weekly chart (light blue line is six year long downtrend)

Daily, needs to go into earnings with a 67.xx share price. I think that sends it to 75 pretty quickly, and once it makes a new 52w high, there’s not a ton of resistance between 75 and 90.