Earlier today the market received the Q1 report of Nebius. This was one of two AI stocks I highlighted in April that were so stupid cheap that even if the market trended lower they should do okay. The other was MU. NBIS has run hard since that piece, up 100% from then mid day today. But I wanted to do a quick piece to do some updated thoughts on earnings.

This was the first full quarter they’ve been public since they divested the yandex assets. You can read their inaugural shareholder letter here. It’s worth reading if you’re interested in the stock.

The most important piece of their business continues to be their core data center business. By the numbers Q1 was right in line with what their projections were last quarter. 249mm ARR run rate, kept the guidance for full year ARR at 750mm - 1b, had slightly less cash on hand and slightly higher CapEx spend than guided, but that’s not a completely bad thing as it can accelerate growth. ]

The build outs of their data centers in Iceland and Kansas City are complete, and their NJ location will be coming online soon.

They also spent time in their letter talking about the companies they own stakes in, including Avride, Toloka, TripleTen, and ClickHouse. While there’s potential okay to explosive upside in the first three the big one is ClickHouse, a database software provider that competes with ElasticSearch, MongoDB, and Snowflake. Nebius owns 28% of the business and they (clickhouse) is rumored to raising again at a 6b valuation, a 3x increase since their 2021 funding round at roughly the same valuation. That puts NBIS’s stake valuation at 1.6B USD.

On funding news Jeff Bezos invested in Toloka in early may, but it didn’t increase its valuation enough to be notable. Only the investor name is.

So with 1.5b of liquid cash on hand, and an ownership stake in ClickHouse at another 1.5b and no debt you can lop off 3b of the market cap to get the Enterprise value.

With an expected ARR of 750mm - 1b by EoY, and a market cap (at $39.14) of 8.95B and an EV of 5.95B, NBIS is trading at an expected range of 6x to 8x ARR/EV. But therein lies the issue.

One of the members of the subscriber discord today said that NBIS was trading like hyper speculative nanocap shitco. It should trade like that. At $39.14, if you think they’re able to hit their guide and that ClickHouse will be able to continue its impressive growth and eventually NBIS will be able to monetize it’s take for the rumored 6b value or higher, NBIS is cheap here. If you think by this time next year they’ll be able to print positive EBIDTA, slow CapEx spend to <EBIDTA and print any positive FCF, its cheap here. If you think that the AI boom is in the early innings and will continue and that NBIS’s solid management plus being European will help position it to take a lot of abroad business, its cheap here.

If you think any of the above won’t happen, or that the 1.5b they have in cash will be gone by the end of the year and that ARR EoY target won’t get hit until a year from now, suddenly the stock might be trading at 12 - 13x ARR/EV. Add in the potential that NBIS might not be able to monetize any of their ownership stakes, that multiple might even be higher.

The stock hasn’t even been public since it was relisted long enough to not be influenced by Yandex’s price action for the 200dma. That newness and its history makes it under covered by the street, with only three analysts listed as having price targets and earnings numbers on it. There’s a lot of grey area with NBIS. This all adds to the somewhat psychotic price action as it had a 14% range today. After the print. The market isn’t sure what to make of it, because a solid argument can be made for both sides.

This is a name I’ve pretty long, and if management hits its EOY target it probably has 50 - 60% upside over the next seven months. Saying that, I do expect it to be a little unstable at these levels until the market gets more information, or the stock gets more street coverage.

At $20~ this name was a steal, at $40 it likely still has material upside, but now its getting large enough it needs more institutional buyers which likely won’t come until either bullish notes get written by the sell side or other buyside longs, or NBIS starts showing people more than just one quarter of great growth. A miss next quarter will send this much lower, same with a miss any other quarter this year, and that increased downside is why the stock was so insane today. Something that’s likely to continue near term.

So if you’re long, be aware we’re likely going to see some higher vol near term. It might not move the stock much a few weeks from now, but I do expect more movement in both directions on NBIS.

The other name that I need to do any update on is Peloton. It saw obscene call buying for the $7 strike on July expiration. This is before their next earnings report, so this buyer is expecting either a technical reason or fundamental reason for the stock to have another huge move up in the next eight weeks.

About an hour after those were posted someone on a financial forum said that they’re a peloton insider, or know a peloton insider and they received and offer from Lululemon to buy them for $4.11B USD. That poster didn’t say if that was EV or the marketcap number.

If that was an EV offer I don’t think Peloton’s management would even entertain that, as that’s about $1 north of closing share price on Tuesday of $6.71. Accepting that EV number as a buyout would mean they made a mistake hiring a new CEO (as they could’ve gotten the company sold with the interims) and that after crunching the numbers six ways to Sunday they don’t see any way to squeeze more revenue or grow memberships. It would be an admission of defeat.

On the other hand, if that was the market cap number, that puts the buyout price in the mid 10.xx range. While I think still low, would value them at somewhere between 11 - 12x NTM EV/EBIDTA. Which again, if they knew this offer was coming and they were planning on considering it there’s no reason they should’ve brought in a new CEO. But selling at this level, while I think might be a mistake, would’ve been as much of one as if its in the mid 7s.

There’s many reasons they could feel a sale is necessary, the biggest one being lease agreements, which a buyout allows them to get out of their Hudson yard location. Which is the largest expense on their books and something they really need to downsize.

The other fundamental change that might be coming soon is the long rumored Zswift competitor for the bike and Trend and built in ads. I estimated that could eventually drive high margin revenue that will gush down to the FCF line. If Peloton plays their cards right, they could spool this up to somewhere between 5 - 15mm a quarter in ad sales. Assuming huge op margins of north of 65%, that’s a lot of extra cash that isn’t in the guide right now.

In an similar vein, Peter Stern has said he wants to make the peloton equipment cheaper. An easy way to do that is to copy Amazon’s Kindle. You have to watch a 15 second add every time you start a class. If you do so, you get the bike for $400. If you don’t want to do that, well its $1,400. This would likely be FCF negative near term, but very much spike user growth, which would be bullish.

I expect some sort of announcement in early June.

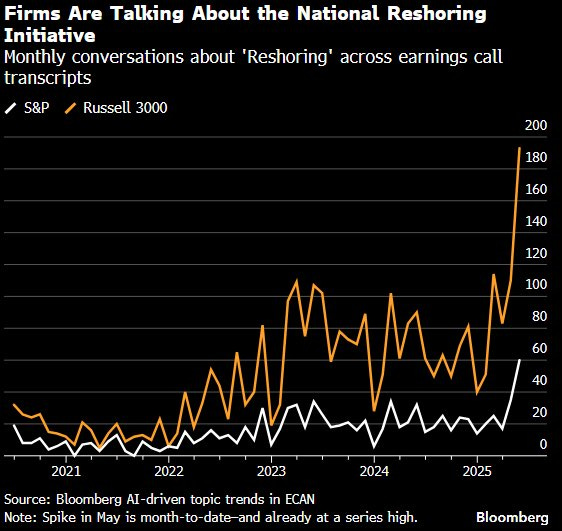

Last, I’m still long Honeywell, they’re still working through their break up. If the market keeps marking up quantum stocks, if reshoring becomes another huge trend that is shown in the Bloomberg chart above, Honeywell (and Zebra) are two companies who has factory automation that will benefit. Not to mention they do still have a solid aviation division.

Long story short its not insane to think Honeywell has 20 - 30% upside from here, to about $280~ before the break up happens. Given the buybacks and yield its not a bad defensive long to tuck away and forget about it.

The offer for PTON is too low.

there is a discord?