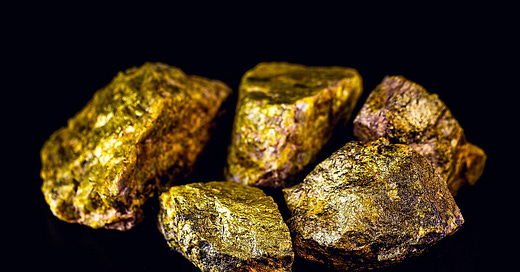

Uranium Miners

With Stargate coming, is this sector the next upside play in the nuclear power space?

As many of you know, Constellation Energy is a huge holding of mine. It has been since the spin off. Its growth has been nothing short of mind melting, as the stock price is up 800% since the IPO price in less than three years. Even the rosiest projections in 2022 wouldn’t have seen this level of growth coming, as the big story for CEG back then was how at home EV chargers were such a power suck that the growth of Tesla and other EV car lines were going to provide a solid tailwind of power needs.

That thesis has almost entirely given way to one of power demand needs for AI and data center. Demand projections have gone from 10 - 15% power demand increase over the next 10 years (approx 1 - 1.5%~ a year) to 4x that, of 40 - 50% increase in power demand requirements between now and 2035. This demand spike won’t be entirely linear, as Data Centers are not built overnight, but is instead expected to gradually ramp up over the next two to four years, and then spike higher into the end of the decade before grinding higher again into 35. Today’s piece is going to focus on that implied spike in 27/28. Because if that demand spike does happen, then the cost of uranium (the material needed to create nuclear energy) will fly through the roof, and miners will explode with it.

Given that we’re now two full days in the President Trump’s and we now have $500b going toward building Data Centers in the US via Stargate. I’m not entirely sure that is real, and not just a massive hail Mary by Sam Altman, but if it is even 10% real the coming supply crunch will be huge.

The moves in the following mining names will be explosive if that happens. Heck some of these miners are already grinding higher just on investors wanting exposure to the base material the powers nuclear.

I want to stress that, much like every other mining company in existence anywhere, these are highly speculative securities. There are a lot of things that can go wrong with these names, both broad, like natural disasters, fires, logistic issues, price of commodity going lower, government regulatory group causing problems, and company specific issues, which we’ll get into below. This shouldn’t be a sector you have a heavy allocation to unless you think its going to work soon, otherwise you’ll bleed out opportunity cost while these things trade sideways (if not down) and the rest of the market moves.

With that disclaimer out of the way, let’s talk Uranium miners!

Keep reading with a 7-day free trial

Subscribe to Sleepysol’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.