Weekend market thoughts and earnings previews

Choose your own adventure with the QQQs, some Nintendo news and Peloton thoughts and earnings previews.

Choose your own adventure.

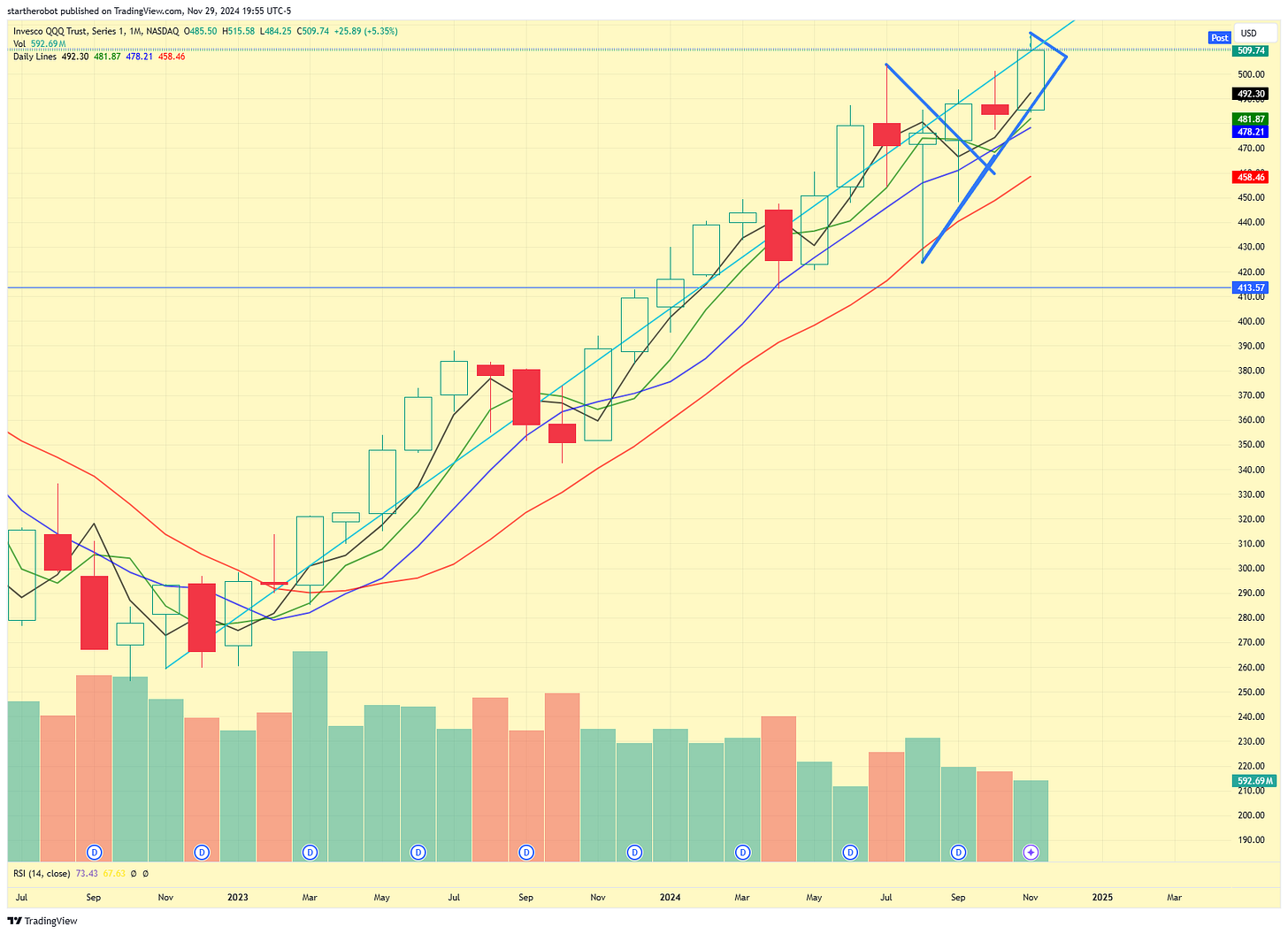

The QQQ weekly candle is screaming at you that we’ve peaked and we’re heading lower, likely starting next month:

On the daily chart it’s one of indecision, mostly due to it being a half day, but the QQQs look like they’re breaking out:

On the monthly, the QQQs are still grinding higher but bumping in the resistance/support line that its been trading around since the ‘22 bottom:

Given that more than 50% of weight of the QQQs is worth about 30%~ of the S&P 500 index right now, if you think the weekly is the chart to ignore and that the monthly is pointing to more upside, then it’s easy to be bullish on the market cap index.

There are three types of market participates. Those who are involved or paying attention every day. These are mostly investment professionals but can also include personal/retail traders who actively pay attention to the day to day gyrations of the market. The next level down is the hobbyists. These are people who follow the market, maybe place a trade (or ten) each week, but if they don’t log into their investment app for 2 - 3 days they aren’t super worried. The third group is the shoeshine boys. They’re your mom, brother, friend, sister, random co-workers and whomever else who only remembers to either check their 401(k) or stock portfolio or just think about investing in general when something so big has happened in the market that it has leaked beyond just the financial news and blogs and is in general circulation.

These first two groups make up 95%~ of fin twit at worst. The third group makes up the majority of people who text people in the first two groups when bitcoin gets close to 100k and they ask if now is a good time to buy. Or insert any other stock/big news story.

It’s important to know about how all three groups are thinking about the market when talking about sentiment. A lot of people like to use sentiment, especially twitter sentiment to try to call out tops (and bottoms). The issue is sentiment doesn’t matter nearly as much as the average trader thinks. The third group usually controls the most passive bid dry powder, while the first group is important for fast moves and if they decide to dip out/buy like crazy the hobbyists and the shoeshine boys won’t be able to hold them off in the immediate term. The broader issue with sentiment is without a catalyst everyone can be max bullish and not lose money. The same can be true of bearishness/down markets. Everyone can be max bullish into the end of the year, heck well into January, and without an ‘event’ the market could continue to push higher.

Heck the market has been pushing higher since July when inflation broke and shadow banks (aka mega caps) stalled out. They’ve barely moved up and we’re 10% higher since then. More on those below, but back to sentiment.

I personally think sentiment is a little far out on its skis. Saying that, I think there are two major near term events that we need to be worried about, and one major flows reversal that few are talking about. The first major event is this upcoming Friday with the November jobs numbers. The market is expecting a very robust jobs number for November because of 1) hurricane normalization that made October a lot weaker than expected, and 2) post election hiring. Companies have a general idea of what the next four years will look like now, so they can feel more comfortable making hiring decisions. If this number comes in soft, and some of the regional data points to not the best November so its not out of the question, that could be the reversal that pushes us meaningfully lower.

If not the jobs number the next risk is mid month. What does the fed do when compared to market expectations? Right now the market thinks 25bps and pause until ??? I still maintain they should’ve only done 75 bps of cuts total this year, which they’ve already done. So I think any more cuts would be a mistake. If the jobs number comes in strong expect no cut in December to start gaining some traction. We’re more than 15 days out from when they start their meeting as of writing this. There’s no way to think about what they should do and compared against risks of what they end up doing until we get through the jobs number.

Last, flows. There’s a ton of money sitting in various muni’s bank accounts that has been given to them by the IRA bill that if not spent by 12/31/2024 revert back to the fed. The fiscal release this provides should keep the party flowing until at least then. Likely into the first few weeks of January. Coupled with the Biden admin trying to seemingly spend all of the money on their way out the door with trying to get more authorization to Ukraine, put Ozempic and other expensive weight loss drugs on medicare and other smaller boondoggles, it seems like the fiscal receipts party is nearing its end.

For me I’m choosing caution. I think the market is going to see an aggressive pull back once the fiscal party stalls out. Possibly worsening if Q1 GDP numbers start coming in a lot lower than expected. Barring the jobs numbers on Friday being very bad I think this likely starts with a stall out in January and then something like a 10 - 15% pullback between then and tax day. Until then? I think there are some stocks we can watch near term to see how much higher we’re going to push until that reversal process starts showing up more and more on the tape. More on that below in the week ahead preview.

Some thanksgiving/Black Friday news and notes.

As some of you may know I use to play video games at a pro-ish level. SC:BW, SC2:WOL and a little HOTS, and Halo3 were my games of choice. I wasn’t good enough to squeak by scrapping together minor tournament wins here and there until twitch.tv took off (when I active it was Justin.tv until right before I pulled back). Streaming wasn’t a big thing back when I played, mostly because internet connections weren’t always the greatest. So instead I made beer money and spending cash doing freelance QA for indie and mid sized developers. They loved people who were perfectly comfortable playing the same level 20+ times just to see if they can re-create various bugs/issues. Or find known issues.

I bring this up because I still have a few friends that are active in that space. One of whom texted me Happy Thanksgiving on Thursday. We got to talking about the state of games and the Switch 2. He is convinced it is going to get announced via a Nintendo Direct or live event during the week of the 20th in January. Before the end of the month for sure. His reasoning for this is he (and the company he works for) has been asked by a lot of projects to get notes in for a timeline that lines up to that area. Chinese production leakers are starting to push things out pointing to a March release. All we need now is a dev kit to accidently hit ebay.

The market is starting to sniff this out as well. The ADR is already starting to move, up 10% in the last week and breaking/sitting at the downtrend line. If it breaks that its likely heading to a new ATH. I wouldn’t be surprised if the ADR gets close to 20 before the announcement given how cheap it is. It just needs a catalyst to move the stock.

The Tokyo listing (7974.T) has been grinding higher the last few years. The yen weakness is what has kept the ADR capped. The switch 2 should send revenue to 12B Yen, if not more depending on how many consoles they’re able to produce. If that happens 20 USD and 10k yen might be cheap given the cash they have on their balance sheet. We’ll find out in 60 days or so.

We’ll be talking more about Nintendo, as well as Japan in general later this week. I think there’s some interesting opportunities away from the dumb net:nets that everyone seems to want to chase there.

Friday was a low volume half day, but it didn’t stop Peloton from hitting a new 52 week high and more importantly breaking above the 9.88 level which had a ton of resistance. Huge breakout and now we need to start talking about if it’s going to get back to the low end of the IPO range of the mid 22s (seen at the top of the below chart. There’s not a lot of huge resistance between 10+ and 14ish. 12 might cause it some trouble but really its 10+ → 14ish → 22. Above that? Well we need to see decent user growth (not shrinkage) but if Peloton can somehow grow users again (and supposedly the new TJ/JJ Watt ad tested well and the partnership with Costco seems to be doing okay) we might see 22 if not 30. Will continue to be worth keeping an eye on it as it has shown amazing strength since I first wrote it up a few months ago at $3 a share. There is still a very healthy amount of shorts, ones who likely won’t be covering here. That’s notable because we haven’t really seen this ‘short squeeze’ yet. Once they start covering, the near term gains will finally start to slow. The more stubborn they are more upside there is. Hopefully 30+ by end of 2025.

Trump 1.0 was good for China. Mostly because they were still growing as an economy and hadn’t hit the demographic flip point yet. That has come, creating headwinds for the Chinese economy over the next few decades. Saying that the bearishness specifically from the Trump election w/r/t China seems overdone. A lot of names are back at their September breakout levels again. Wouldn’t stun me to see some names find some strength into the end of the year. Especially if you think the dollar might be rolling over, as that will only help the foreign names. I bought some Baba jan 92s on this thesis. Also on the thesis one should always fade big opinion pieces in the economist. As they’re always the last to the trend.

I had a paragraph+ written about how every macro fintwit account is posting about how the dollar is massively reversing and rolling over and that was definitely the peak, and you should short it and it was a clear and obvious trade. I was going to write that and how I don’t think the dollar will agree with what ever chartist thinks and will follow a set pattern, and to be careful if you were thinking about shorting the dollar. Then Trump tweeted his attack on BRICS and now everyone is saying ‘oh boy the dollar might regain its strength.’ Until either GDP rolls over, or until Trump’s admin gets fully up and running in March/April and makes a strong effort to get the dollar down, I’d be careful on any dxy short until then.

Last, I’m happy to sell my Hasbro shares to Elon for $100 a share.

Earnings Preview:

With few exceptions, the list of companies reporting this week aren’t of the highest quality. Let’s start with one that I think is the clearest risk on/risk off names. My chart of the week.

Keep reading with a 7-day free trial

Subscribe to Sleepysol’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.